White papers

Use our white paper search or select a quick entry below to display white papers based on product type, supplier or application.

The 10 latest white papers

Comparing ICP-OES Analyzers' Plasma Views: Axial, Radial, Dual, MultiView, and Dual Side-On

A Comparison of the Basic Functioning of the Technologies

View white paper

Effluent Phosphate Recovery & Recycling

The Latest Analytical Solutions

View white paper

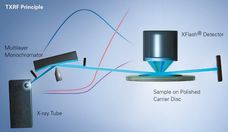

X--ray Fluorescence Analysis of Polymers

Advanced elemental analysis offers exceptional possibilities and advantages

View white paperWhite papers by application

White papers by product type

Promote your white papers on chemeurope.com

You spend a lot of time writing white papers and technical articles and offer them on your website. But the access figures are sobering. What can you do to make your white papers reach more interested parties?

On chemeurope.com, which has over 2.3 million users, your potential customers search specifically for white papers and technical articles that explain methods and explain applications.

You receive high-quality sales leads

You position your company as an expert in your field of expertise

Once written, your content generates sales leads again and again

Curious? Learn more now